Get your first

home loan today.

Explore our low rates and flexible mortgage options for first home buyers.

Explore our low rates and flexible mortgage options for first home buyers.

We’re ready to listen

Buying your first home is a big deal. As well as the excitement, there’s a lot to research, and plenty of jargon to untangle before you can feel ready to make a move. We’re here to help guide you step-by-step through the process.

As a first-time home buyer, preparing to purchase your first home can become a perplexing (and, quite frankly, daunting) task if you don’t know where to begin.

Fortunately, various government incentives and grants offer Australians many opportunities to reduce costs and speed up the home-buying process.

Understanding these grants and whether you qualify can save you days of work and thousands of dollars on your home loan. However, the frequent updates and amendments to these incentives can often leave first-home buyers scratching their heads over what they can and can’t leverage.

Here at Homestar Finance, we’ve compiled a comprehensive guide to every incentive available to first-home buyers.

Our aim is to help you cut through the confusion, and potentially save a significant amount on your first home purchase.

Download our first home buyer guideVariable principal & interest

Variable principal & interest

Variable principal & interest

A myriad of grants, incentives and exemptions are available to first homeowners in Australia. The main 4 categories that these financial aid incentives fall under are as follows:

Some of these, such as the first home owners grant and stamp duty exemptions are controlled and regulated by individual states and territories. On the other hand, schemes made available as part of the wider Home Guarantee Scheme operate on a federal level and are administered by Housing Australia on behalf of the Australian Government.

Most state-level grants and exemptions are awarded solely based on eligibility criteria and are available to anybody who meets the relevant criteria. Conversely, federal schemes usually have a limit on the number of applicants accepted, and qualifying requirements tend to be more situation-specific.

Rest assured, however, that almost all first home buyers in Australia are usually eligible for financial assistance. Even if you do not qualify for one of these grants, it doesn’t necessarily mean you will be ineligible for all of them.

Some first-time home buyers may be eligible to benefit from multiple grants as long as they meet the appropriate requirements. Moreover, some of the grants or incentives in this article are also available to non-first-time home buyers.

Continue reading to learn more about each specific grant and how they can help you as a prospective property owner.

The First Home Owners Grant is a state-specific, one-off payment designed to provide home buyers with a much needed financial boost when purchasing their first property. Although the grant itself is standardised across the country, the amount provided by the FHOG and the qualifying conditions do vary across states and territories.

At the fundamental level, the FHOG’s basic qualifying criteria remains the same for all Australians:

However, each state has different qualification criteria when it comes to the property itself. For instance, some states only provide the FHOG to homebuyers purchasing or constructing a new home (no previous occupier). Whereas, other states may approve the grant for “substantially renovated homes”.

Available only to those buying or constructing a new home (no previous occupier) or in certain states) “substantially renovated homes”. Furthermore, most densely populated states also have a property value limit for FHOG qualification.

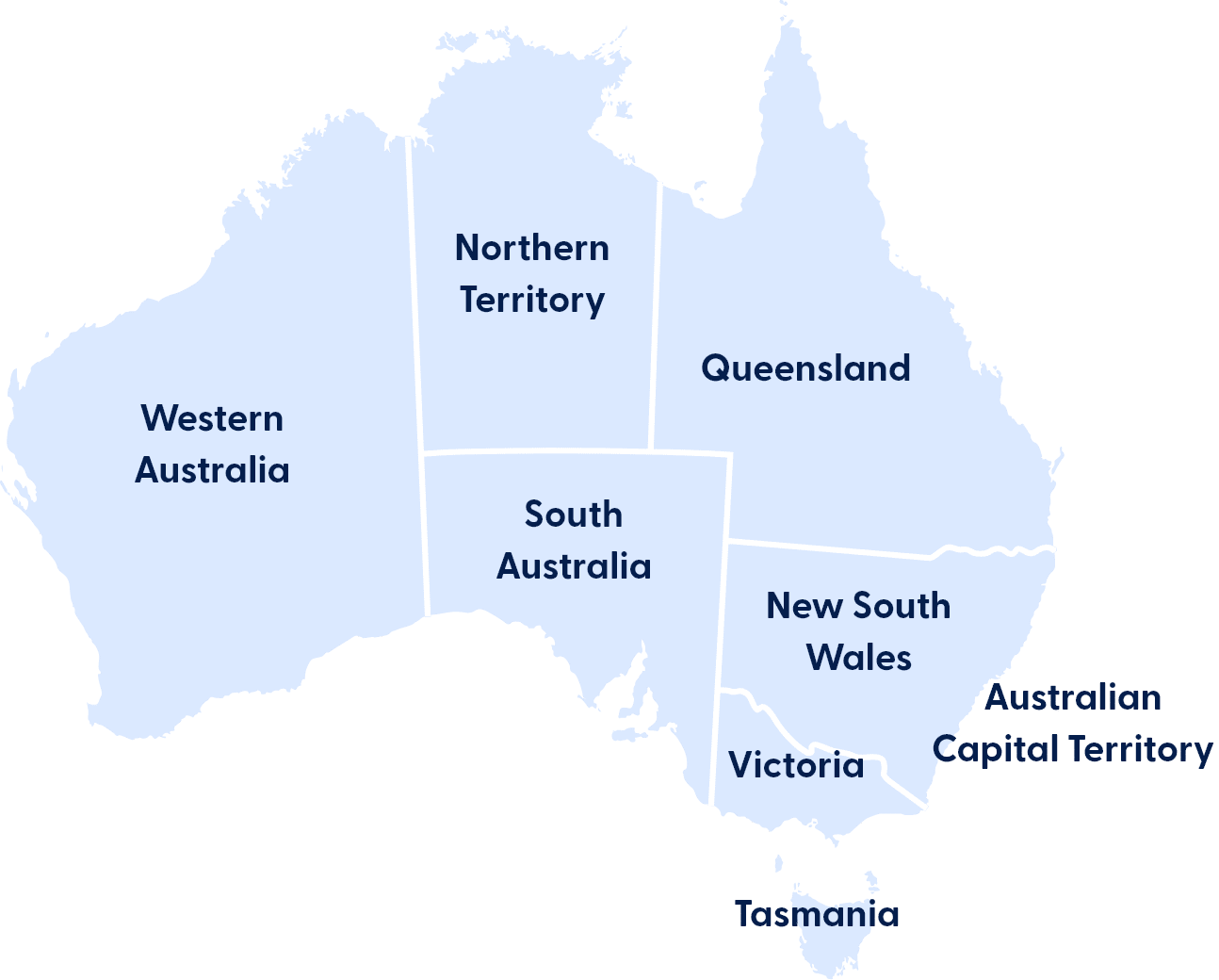

For each state and territory, click on the icons on the interactive map to view the value of the FHOG and property requirements.

A $10,000 FHOG grant is available for people building or buying a new home NSW. Available for new or substantially renovated homes valued up to $600,000 or up to $750,000 for a combined land and home package.

A $10,000 FHOG is available to buy or build a new home in VIC when the total property value is $750,00 or less.

A FHOG of $15,000 for buying or building a new home in QLD or buying a substantially renovated home. Applicable for a combined land and property value up to $750,000.

For properties valued $575,000 or less, a grant of $15,000 is available in SA for building or buying a new home.

A $10,000 FHOG for NT buyers to build or purchase an existing new home of any value.

A location dependent FHOG of up to $10,000 for building or buying a new home in WA. The total property value is up to $750,000 for Perth metropolitan areas ‘south of the 26th parallel’ and up to $1 million for properties ‘north of the 26th parallel’.

Learn more about the First Home Owner Grant here.

What type of property can qualify for the first home owners grant?

In the context of the First Home Owners Grant, a qualifying “home” can include:

Generally speaking, as long as you are purchasing a home for the first time and you intend to occupy the home as a primary place of residence, your property should be eligible for the FHOG.

Do keep in mind that if the property exceeds the state-specific property price threshold, there is no way to qualify for the First Home Owners Grant, although you may still be eligible for other schemes and stamp duty concessions.

You may be able to apply for multiple grants or be exempt by receiving specific grants. Check the eligibility criteria.

Stamp duty is a one-time dutiable tax that applies when you purchase a high-value asset, i.e. a property (or transfer a property title into your name).

Also referred to as transfer duty or land transfer duty, the total amount is usually payable after settlement and the amount payable will vary depending on your location and circumstances.

Typically, the stamp duty payable depends on the property value. Stamp duty exemptions are usually available to first home buyers who are purchasing a property under the relevant property price cap. However, you may still be eligible for stamp duty concessions even if you are not a first-time buyer or purchasing a high-value property.

Each state and territory has its own stamp duty concessions and eligibility requirements. Most states follow these general guidelines when it comes to stamp duty exemptions.

The following is a list of stamp duty exemptions and concessions specific to each state:

In lieu of the abolished FHOG, the Home Buyer Concession Scheme offers ACT home buyers a stamp duty concession of $34,790 for all home and land properties. Total household income thresholds are based on the number of dependent children and $186,650 is the maximum.

Under the First Home Buyers Assistance Scheme, eligible NSW buyers may be exempt from all or part of the transfer duty tax when purchasing any property (new, existing, or vacant land) valued up to $1 million. Additionally, NSW first home buyers have the option with the First Home Buyer Choice, NSW first home buyers have the option of yearly property taxes instead of lump sum stamp duty on properties up to $1.5 million.

A stamp duty exemption is available for all house and land packages of any value under the House and Land Package Exemption (HLPE). (Amount of exemption? $)

There are 3 options for stamp duty concessions in QLD. First home owners can save up to $15,925 on stamp duty for homes valued $550,000 and under. If the home is over $550,000, then buyers can apply alongside all other homeowners for a concession, saving up to $7,175 in total duty fees, regardless of property value. The concession for buying vacant land valued under $400,000 to build your first home can bring you savings of $7,175.

There are no stamp duty concessions or exemptions in SA for all types of property buyers.

50% tax duty concession for first home buyers of established homes with a property value of $600,000 or less.

First home buyers of new or existing homes are eligible for full stamp duty exemption on properties valued at up to $600,000. With a 50% stamp duty concession for properties valued between $600,000 and $750,000. First home buyers of property valued no more than $200,000 can also apply for a family exemption or concession of stamp duty. All buyers are eligible for stamp duty concession for properties valued up to $550,000 that will be a principal place of residence for at least 12 months.

Most states also have additional tax concessions available, such as the off-the-plan concession available in Victoria. Be sure to familiarise yourself with the concessions and exemptions available in your specific state, as you may be able to shave thousands of dollars off out-of-pocket costs.

The Home Guarantee Scheme is the overarching term for a series of federal-level grants that have been introduced to try and provide financial assistance to Australians in need.

These schemes generally look to guarantee a portion of the property value, so that Australians can get their foot in the door sooner and with fewer upfront costs.

The wider Home Guarantee Scheme has been subject to multiple changes after the results of the 2022 Australian Federal Election, so it can be a bit tricky to keep up with the changes.

As of now, however, these are the schemes that are available to Australians under the Home Guarantee Scheme:

We’re here to break down these nationwide schemes both new and old, as well as any updated or removed schemes so that you can get a clear picture of exactly what type of financial assistance is available to you.

The First Home Guarantee has recently been implemented by the Australian Government to replace and combine two previous schemes: the First Home Loan Deposit Scheme (FHLDS) and the New Home Guarantee (NHG). It combines the benefits of both to create an overarching scheme that’s more accessible and available to homebuyers.

The purpose of the FHBG is to eliminate the need for a substantial deposit and assist home buyers by speeding up the process of purchasing their first home.

Under the First Home Guarantee, the government guarantees a portion of your home loan (up to 15%), meaning that you could purchase a home with only a 5% deposit while also avoiding costly lenders mortgage insurance (LMI) premiums.

The FHBG has been made available to 35,000 individuals over the next financial year (1 July 2022 – 30 June 2023) and is managed by the National Housing Finance and Investment Corporation (NHFIC).

If you’re curious about eligibility criteria or further information regarding the First Home Guarantee, make sure to visit Homestar Finance’s comprehensive breakdown of the FHBG.

First Home Loan Deposit Scheme (FHLDS)

As mentioned above, the First Home Guarantee is intended to replace two previously existing schemes. Of these, the First Home Loan Deposit Scheme was specifically designed to assist with the purchase of a new or existing residential property.

Eligible property included:

The terms of the FLHDS were almost identical to the First Home Guarantee but it had been limited to only 10,000 applicants.

New Home Guarantee (NHG)

Like the FHLDS, the New Home Guarantee followed the exact same grant conditions as the First Home Guarantee, i.e. the government would insure up to 15% of the home loan, reducing the amount of deposit required for first home buyers.

However, the New Home Guarantee was specifically designed to help first home buyers in purchasing or constructing a new home, rather than an established or existing home.

The NHG was also restricted to 10,000 applicants, meaning that the First Home Guarantee provides financial assistance to more Australians than both of the previous schemes combined.

The Family Home Guarantee is a federal-level scheme that looks to alleviate the burden of purchasing a residential home for single parents. Any single parents with dependents, looking to purchase their first home are eligible for the FHG.

Much like the FHBG, under the Family Home Guarantee, the NHFIC will guarantee a portion of your home loan so that you are able to purchase the home quicker and with less deposit. The FHG can insure up to 18% of the mortgage, meaning that if eligible, single parents can purchase a home using as little as a 2% deposit without incurring LMI.

Unlike other schemes on this list, however, the FHG is not only limited to first home buyers. Family Home Guarantee applicants can be either first home buyers or previous owners who do not currently own a home. This includes:

Other relevant qualifying conditions for the Family Home Guarantee include property price caps and income restrictions.

If you believe you may qualify for the FHG, be sure to check relevant information provided by the NHFIC and check with your lender to see if you are eligible to apply.

Incoming additions to the Home Guarantee Scheme

Along with updates to the Home Guarantee Scheme, the 2022 Election has also brought about some much-needed additions that are sure to make things easier for many first home buyers around Australia.

The Regional Home Guarantee was announced as part of the 2022-23 Federal Budget to try and provide more support for prospective homeowners looking to purchase outside of the densely populated major cities.

Starting October 2022, under the RHG, 10,000 eligible applicants will be guaranteed up to 15% of their home loan. Meaning, anyone purchasing a home within eligible rural areas will be able to leverage the RHG to purchase a home with just a 5% minimum deposit.

Similar to the Family Home Guarantee, the Regional Home Guarantee will be made available to non-first home buyers as well, so long as they meet the other relevant requirements.

The First Home Super Saver (FHSS) scheme allows Australians to save for their first home by making personal voluntary contributions to their superannuation fund whilst maximising the concessional tax benefit. These concessional contributions are taxed at 15%, which is usually lower than the average marginal income tax rate. Additionally, assessable FHSS amounts benefit from a 30% tax offset.

The FHSS scheme provides flexibility. Participants can withdraw up to $15,000 of their voluntary contributions from any financial year and up to $50,000 across multiple years, along with associated earnings.

One of the advantages of the FHSS scheme is that it is not limited to Australian citizens or residents for tax purposes, meaning that non-Australian citizens or residents can also take advantage of the scheme.

It’s important not to sign any property contract before requesting a FHSS determination. When participants are ready to use the funds to buy a home in Australia, they can submit a request to release their FHSS amount plus associated earnings.

Contact our friendly team or fill in this form and we’ll get back to you pronto.

Australians deserve a better deal. That’s why we’ve been challenging the market and rewriting the rulebook, since 2004.

By listening and understanding what’s important to property owners, we’ve developed a customer focused approach that helps thousands of property owners feel in control and save money every day.

1 Rates shown apply to new eligible Owner Occupieda or Investmentb home loans only, up to 80% LVR, loan amounts up to 2,500,000 and at least one applicant is on PAYG employment. Rates are subject to change without notice. Existing borrowers may have different interest rates which are dependent on the rate offered to the borrower at the date when a home loan settled and any reductions or increases the lender decided to make on the existing loan over time. Accordingly, there is not one standard variable rate that applies to all Homestar Finance home loans and existing customers can confirm their current rate(s) by logging in to internet banking or by contacting customer service. Terms, conditions, and eligibility criteria apply.

2 Comparison rates are based on a $150,000 loan amount over 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

3 Third party cost(s) incurred by service provider(s) are payable and may vary or increase depending on the service provider, nature of the service and request. Any additional cost(s) are passed on directly to the applicants(s). If there is a variation or an increase, a separate quote will be provided..

4 Where Lender Paid LMI is applicable, or applied, then settlement fee applies.

5 Discharge fee is waived if loan reaches full term as per the loan agreement. Other fees and charges may apply.

6 The break cost fee varies based on several factors, including the number of days left on the fixed rate period, the amount the market rate has moved, the outstanding loan amount and remaining cash flows. Refer to Fact Sheet: Break Cost to find out more.

DISCLAIMER: Terms, conditions and eligibility criteria apply to all our loan products and features. Fees, charges and disbursements are payable. Final approval is subject to credit assessment. Information valid as at 2nd June 2025 which is subject to change without notice. Please consider if the product is appropriate for your individual circumstances. If you need assistance or have any questions about a product or feature and its suitability, please contact our Loan Specialists.

Ⓡ Registered to BPAY Pty Ltd ABN 69 079 137 518