One of the first things you’ll need to consider before applying for a home loan is the amount you need to save for a deposit. Your initial deposit will affect how much you can borrow and some of your loan terms.

What is the minimum required deposit on a home loan?

Generally, the minimum deposit needed for a home loan is 10%. Some lenders may let you take out a loan with less than a 10% deposit if certain other criteria are met.

A 20% deposit is preferable to avoid Lenders Mortgage Insurance (LMI) and generally secure a lower interest rate. A larger deposit may also enable you to pay off your loan faster.

How much deposit do I need for a home loan?

If possible, provide a 20% deposit because lenders can consider a higher deposit less risky and, at times, can help qualify you for better offers.

If your deposit is less than 20%, you’ll usually incur lenders mortgage insurance (LMI) premium. LMI is an extra cost that the lender charges to protect them against the risk of you defaulting on your loan.

Some lenders may accept a 5% or less deposit if you have a guarantor or are part of the First Home Guarantee scheme.

However, the deposit you’re able to put down will depend on your budget and your timeline.

Customer comes first

To determine the exact deposit amount, consider the price range you’re in and how much you’re willing to spend and afford in repayments.

Calculate the deposit you can put down.

Once you’ve found a house that suits you, it’s time to work out your deposit.

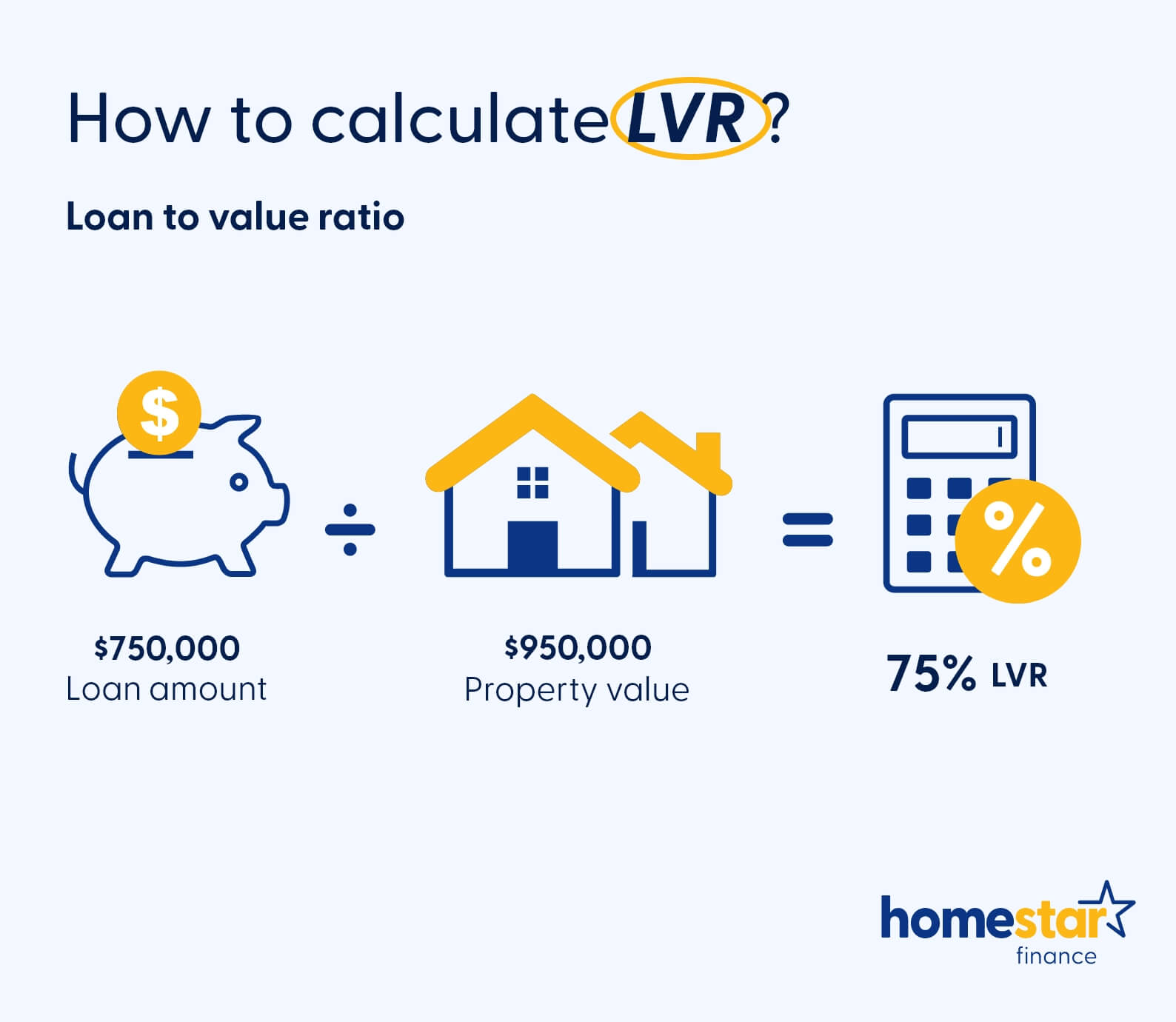

What is LVR (loan to value ratio)?

LVR is used by lenders to assess the risk of a loan. A higher LVR is considered more risky, which is why those with smaller deposits will be required to take out LMI.

You can calculate your LVR by dividing the value of the property by the amount you’ve saved for the deposit.

For example, let’s say you’re taking out a loan for a property valued at $950,000. If you have a deposit of $200,000, then your LVR would be 75%.

Additional upfront costs

In addition to the deposit, there are other upfront costs that you’ll have to pay when you take out a loan.

Legal fees

Buying property involves several legal processes, including conveyancing, title checks, and drafting the settlement document.

Transfer duty

Transfer duty (previously known as Stamp duty) is a government tax that varies between states and territories and can be quite a significant expense. It also varies depending on whether you’re a first home buyer or purchasing an investment property. You can use a stamp duty calculator to get an idea of how much this will cost.

Mortgage establishment and registration fees

This cost also depends on the state or territory where the property is located and sometimes on which lender you use.

Moving costs

Your preference, the distance, and the amount of stuff you take with you will all be factors in budgeting for moving costs. If you’re using a moving service, it’s a good idea to get quotes from multiple companies.

Insurances

If you have to pay lenders mortgage insurance, you may be required to pay it upfront. However, most lenders will allow you to add it to your mortgage so that you won’t have to pay for it straight away.

What is lenders mortgage insurance?

Lenders mortgage insurance (LMI) is an additional cost charged by home loan lenders that is either added to your home loan or paid upfront.

LMI protects the lender where the loan to valuation ratio (LVR) exceeds 80%. The risk is that the borrower is deemed more likely to default on their loan or be unable to make mortgage repayments.

Borrowing power:

How much can I borrow?

A few other factors can affect the amount a lender will lend and the interest rate you’re offered.

Income and expenses

Most people will use their income as a guide to figure out how much they can afford to spend on a mortgage each month, but how much is too much?

This will depend on your individual expenses, household expenses and spending habits. The general rule of thumb is that your home loan repayments should not be more than 28% of your gross monthly income.

Deposit savings

It’s best to try to save as much of a deposit as possible before buying a home, because this may allow you to access lower interest rates and avoid LMI.

The lender will factor in the size of your deposit when assessing your loan application.

Saving history and credit rating

When you apply for your loan, the lender will run credit checks and request relevant banking transaction data for the most recent 3-6 month period. The lender uses banking transaction history to assess your regular expenses and saving ability.

Please note, you can check your credit score online using a credit reporting agency.

The price of the property

The lender you choose for your home loan application will do their own valuation of the property as part of the process.

Get more than a better deal with Homestar Finance.

For great rates, great savings and great service, Homestar Finance has you covered. Fill in your details to connect with a dedicated lending specialist who will guide you through your refinancing options

Self-Employed Home Loans: How to Apply

Conveyancing Fees Explained: How Much Do They Cost?

Can You Have Multiple Offset Accounts For Your Home Loan?

Frequently Asked Questions

Can I buy a house with a $10,000 deposit?

This really depends on the price of the house you’re trying to buy. If the property value is $100,000, then a $10,000 deposit would be acceptable.

However, if you need a larger loan amount then $10,000 may not be enough unless you have a guarantor.

What if I have a smaller deposit?

There are some options available for home loans if you have less than a 10-20% deposit. You can apply for a First Home Buyer Scheme if it’s your first time purchasing a house, but this comes with specific requirements that you must adhere to.

If you have a close family member who owns their own property and is willing to act as guarantor, this may also be an option depending on the bank that you choose.

Some lenders may accept a loan application with a smaller deposit if you have a stable credit and employment history and you’re willing to pay Lenders Mortgage Insurance.

What if I don't have a deposit at all?

Buying a house with no deposit at all is undoubtedly tricky and in many cases, not possible. Even if you apply for a First Home Owner Grant, most lenders would like to see that you’ve saved at least part of the deposit yourself.

If you have little to no deposit, it’s best to speak to a home loan specialist about your financial situation before applying for a loan. The loan specialists at Homestar Finance can discuss your options with you and help you find a solution.