When buying a home or property, understanding how interest is calculated on a home loan is crucial and can save you thousands of dollars in the long run.

Loan repayments consist of two parts: principal repayments and interest repayments. The principal is the set amount of money you borrow to finance your property, and principal repayments refer to the payments you make to your overall loan balance. Calculated interest is the annual cost of borrowing the said amount.

Your interest repayments significantly impact your monthly repayments and the overall payback on your home loan.

Continue reading to learn more about how mortgage interest works, how interest rates are calculated on a home loan and how interest can affect your mortgage.

How Is Home Loan Interest Calculated?

Home loan interest is the annual cost of borrowing your principal loan amount. The amount of interest payable, or how much you pay annually in costs, depends on the amount of money you borrowed and several other factors.

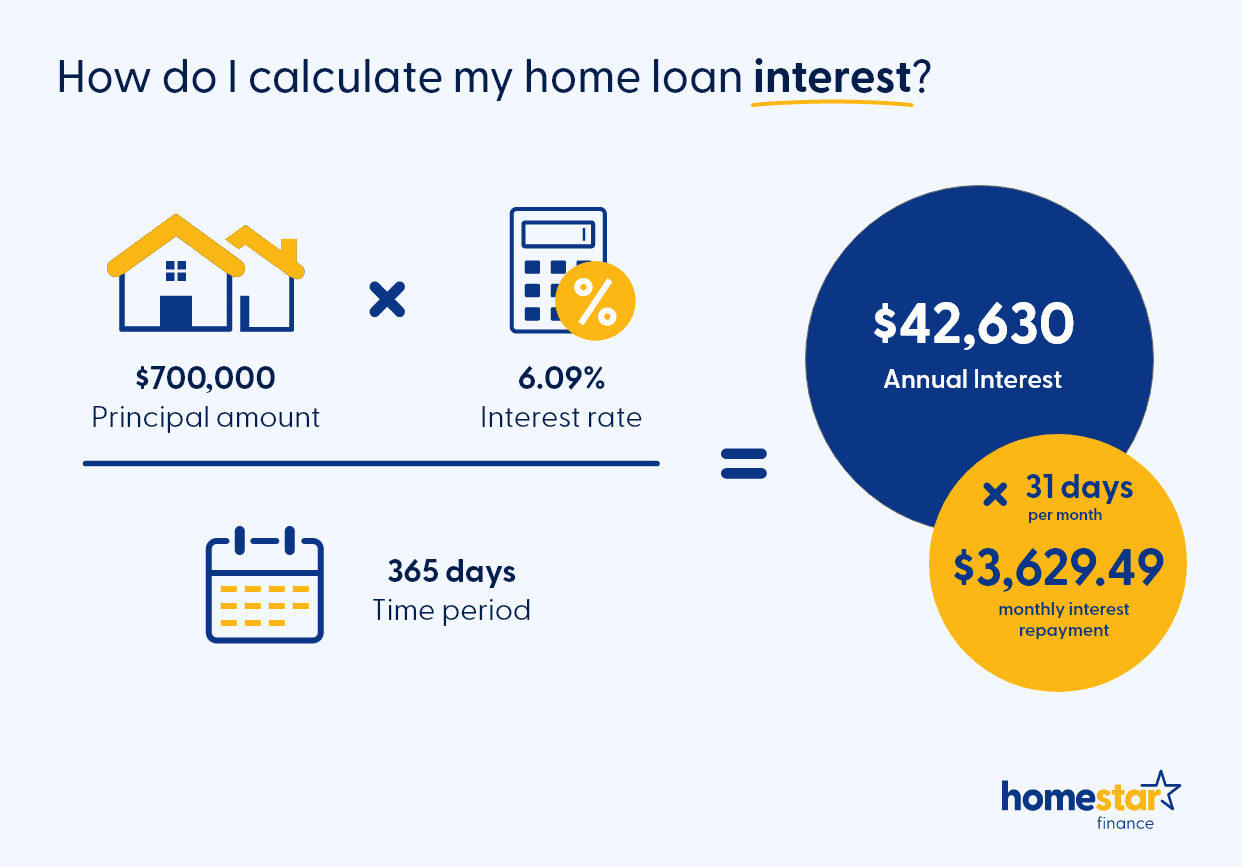

Home loan interest is typically expressed as an annual percentage rate (APR). APR reflects the yearly cost of borrowing the principal amount. To calculate the annual interest, multiply your loan amount by the interest rate. Since APR is calculated by year, we will then divide this amount by 365 (or 366 for leaps years) days to calculate the daily interest amount payable.

Interest Calculation Formula

or in shorthand, (P x R) / T = I

For example, a home loan of $700,000 with an interest rate of 6.09%, the annual interest calculation would be:

- Annual Interest:

($700,000 x 6.09%) = $42,630

- Daily Interest:**

$42,630 / 365 = approximately $116.79

To calculate your monthly interest amount, multiply the daily interest by the number of days in the month. For instance, for 31 days in a month the interest payment would be $116.79 x 31 = approximately $3,629.49.

If you want to avoid doing the maths, use our home loan repayment calculator to calculate your interest amount in seconds.

If you are unsure where to begin with your home loan, chat with one of our loan specialists, who can answer any questions about home loans, interest rates and how to calculate your home loan interest by filling out our enquiry form.

Factors Influencing Home Loan Interest

How much interest you pay on your home loan is impacted by several factors:

Loan Amount

The more you borrow, the more interest you will pay.

Interest Rate and Interest Type

The rate and whether it is a fixed or variable rate.

Loan Term

The length of your home loan can affect the total amount of interest paid. The longer the loan term, the larger the interest amount to paid.

The Reserve Bank official cash rate

The interest rate on your Homestar Finance loan is always based on the official cash rate set by the Reserve Bank of Australia (RBA). This rate is set on the first Tuesday of each month. The official cost of borrowing helps us determine where to set the interest rates for our home loans. Take a look at the current cash rate to see how we compare.

Frequency

Making more frequent payments reduces interest costs over time. By way of example, if you make fortnightly repayments, you will make the equivalent of an extra month’s repayment each year, as there are 26 fortnights in a year.

Outstanding Loan Amount

Making more frequent payments reduces interest costs over time. By way of example, if you make fortnightly repayments, you will make the equivalent of an extra month’s repayment each year, as there are 26 fortnights in a year.

The higher the BBSW, the higher the borrowing cost for the lender, which, in turn, will result in the lender increasing their variable home loan rates.

Fixed vs. Variable Interest Rates

When selecting your home loan, consider whether a fixed or variable interest rate better suits you:

- Fixed Rates: A fixed rate loan offers certainty and can make budgeting easier, as the repayment amount won’t change.

- Variable Rates: A variable rate fluctuates with market conditions, which can save you money when the rates decrease but also result you paying more when rates increase.

How Much Interest Will You Pay?

The total interest you pay over the life of a home loan depends on the type of loan you choose and all the factors mentioned above. To understand your potential costs better, use the above formula or leverage a repayment calculator to get an overview of your financial obligation.

Of course, how much interest you will pay on your loan is dependent on the type of loan you choose and is influenced by all the factors mentioned above. Take a look at our current home loan options (variable vs fixed, principal and interest, or interest-only, investment or owner-occupied) for more information.

Calculate your interest using the formula: (principal x rate) divided by time = interest or (P X R) / T = I. Alternatively, head to our home loan repayment calculator to easily get an overview of the financial obligation.

Tips to Save on Home Loan Interest

The following tips can save you thousands of dollars over the term of your loan:

Offset Accounts

An offset account is an account connected directly to your home loan. You can deposit your salary or savings straight into this account. Then the balance will immediately offset the amount owed on your home loan. Having an offset account is a great way to save on home loan interest, as the loan balance you pay interest on is reduced by the amount put into the offset account. This means that an offset account utilises the influence your outstanding loan amount has on your interest.

Faster and Frequent Repayments

Consider making fortnightly or weekly payments instead of monthly ones. Making fortnightly home loan repayments can save you thousands of dollars over time as you will make the equivalent of an extra month’s repayment each year, as there are 26 fortnights in a year. Remember, when it comes to home loan debt, repaying it more frequently can help reduce the interest costs as you will be paying down the outstanding principal amount more quickly (assuming you are making principal and interest repayments).

Extra Payments

Whenever possible, make additional repayments to reduce the principal amount owed, thereby decreasing the amount of interest charged.

Disclaimer: This article is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered Australian legal practitioner or financial or investment advisor.

Get more than a better deal with Homestar Finance.

For great rates, great savings and great service, Homestar Finance has you covered. Fill in your details to connect with a dedicated lending specialist who will guide you through your refinancing options